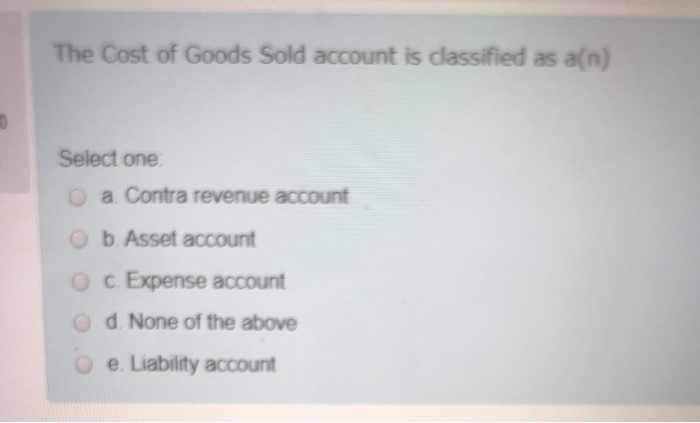

What is a contra expense account?

The calculation for COGS depends on the inventory costing method used by a company. This relationship portrays how COGS is used to assess how efficient the company is in managing its supplies and labor in production. You also have to spend $1 per bath soap on the labor required to craft it and $1 for packaging. Examples of deferred unearned revenue include prepaid subscriptions, rent, insurance or professional service fees.

How to Manage Accounts Receivable for Services Industry Company?

Inventory refers to assets owned by a business that can be sold for revenue or converted into goods that can be sold for revenue. Generally Accepted Accounting Principles (GAAP) require that any item that represents a future economic value to a company must be defined as an asset. Inventory meets the requirements of an asset so it’s reported at cost on a company’s balance sheet under the section for current assets. Generally in the financial statements the revenue account would be offset against the contra revenue account to show the net balance. In double entry bookkeeping terms, a contra revenue account or contra sales account refers to an account which is offset against a revenue account. She buys machines A and B for 10 each, and later buys machines C and D for 12 each.

Inventory Write-Off vs. Write-Down

For instance, the company might debit its expense account 4210 Employee Health Insurance Expense when recording the insurance company’s invoice of $10,000. If the company withholds $2,000 from its employees’ wages to pay part of the cost of the insurance, the company will credit its contra expense account 4211 Employee Withholdings for Health Ins. A contra expense account is a general ledger expense account that will intentionally have a credit balance (instead of the debit balance that is typical for an expense account). In other words, this account’s credit balance is contrary to (or opposite of) the usual debit balance for an expense account. Contra accounts are used to reduce the value of the original account directly to keep financial accounting records clean.

Cost of goods made by the business

See the entries below on how to record the goods returned by customers into the inventories and how it is affected the cost of goods sold. Show the general entries to record sales and sales return in the books of ABC cosmetics. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

- Among the potential adjustments are decline in value of the goods (i.e., lower market value than cost), obsolescence, damage, etc.

- COGS is not addressed in any detail in generally accepted accounting principles (GAAP), but COGS is defined as only the cost of inventory items sold during a given period.

- Unlike COGS, operating expenses (OPEX) are expenditures that are not directly tied to the production of goods or services.

- The most common contra account is the accumulated depreciation account, which offsets the fixed asset account.

- There are several reasons why it is essential to derive a correct cost of goods sold figure.

- To do this, a standard absorption baseis ideal, and any effort expended to design one is worthwhile.

Accounting rules require that a company must write down or reduce the reported value of inventory to the market value on the financial statement when the market price of the inventory falls below its cost. To gain a deeper understanding of COGS and its implications, it is recommended to consult with accounting experts, implement effective cost accounting systems, and regularly analyze COGS trends. Further research and exploration of related terms and concepts, such as gross profit margin and inventory turnover, can also enhance knowledge in this area of accounting.

Examples of Contra Revenue Accounts

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Additionally, the ending inventory is inflated because the latest inventory was purchased at higher prices. This is the advantage of using the FIFO method because this lower expense will result in a higher net income. is cost of goods sold a contra account In typical economic situations where inflationary markets and rising prices occur, the oldest inventory will theoretically be at lower prices than the latest inventory purchased at present inflated prices.

In this method, a business knows precisely which item was sold and the exact cost. Further, this method is typically used in industries that sell unique items like cars, real estate, and rare and precious jewels. Any property held by a business may decline in value or be damaged by unusual events, such as a fire. The loss of value where the goods are destroyed is accounted for as a loss, and the inventory is fully written off. Generally, such loss is recognized for both financial reporting and tax purposes. Current period net income as well as net inventory value at the end of the period is reduced for the decline in value.